GST: Navigating the Goods and Services Tax Landscape

Soheb Lahori

Introduction

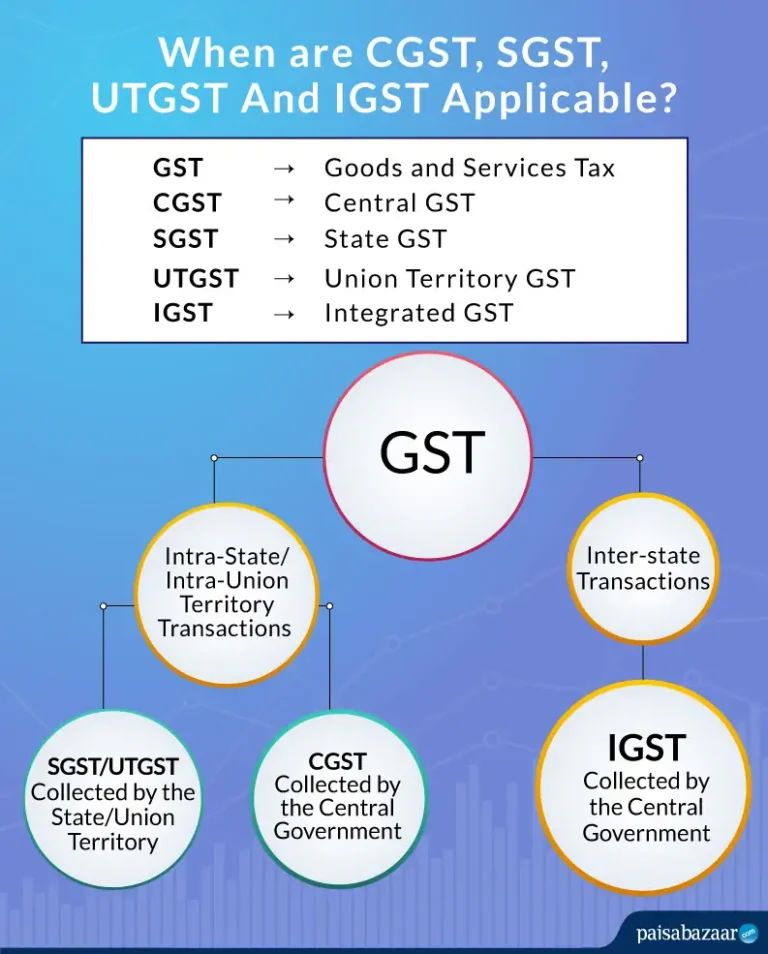

Goods and Services Tax (GST) is a significant change in the tax structure in India. Understanding GST compliance is vital for businesses to avoid penalties.

Overview of GST

GST is a single tax on the supply of goods and services, unifying the indirect tax regime in India.

Importance of GST Compliance

- Legal Compliance: Adhering to GST regulations is crucial for avoiding legal penalties.

- Input Tax Credit: Proper GST compliance enables businesses to claim input tax credits, improving cash flow.

- Streamlining Operations: GST compliance helps streamline business operations and simplifies the tax structure.

Common GST Compliance Pitfalls

- Inaccurate Reporting: Failing to report transactions accurately can lead to penalties.

- Missing Deadlines: Adhering to filing deadlines is essential to avoid late fees.

Conclusion

Navigating the GST landscape can be complex, but with our expert guidance, you can ensure compliance and maximize your tax benefits. Contact us for comprehensive GST advisory services.

Facebook

Twitter

LinkedIn

Email